SUPPLY CHAINS IN CHINA – SUMMARIZING A CHALLENGING 2021

Posted on

Supply chains in China – summarizing a challenging 2021

This year has continued to be challenging for global supply chains, primarily because the COVID-19 pandemic reduces productive capacity while demand for goods is elevated in a globally inflationary environment. As the world experiences various degrees of lockdowns, consumer preferences have shifted to physical goods, adding pressure on the already strained supply chains. The high demand and uncertain market outlook are primary contributors to shipment delays, container shortages, soaring freight rates, and increase in raw material prices. This is not unique to China but does have a heavy impact as many industries have China as a globally dominant supply base. Hence, companies need continued focus on supplier communication, reviewing supplier bases, improving supply chain transparency, taking proactive risk management measures, and working with scenario planning to improve decision making.

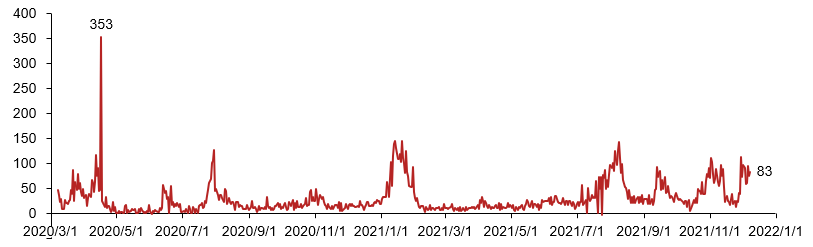

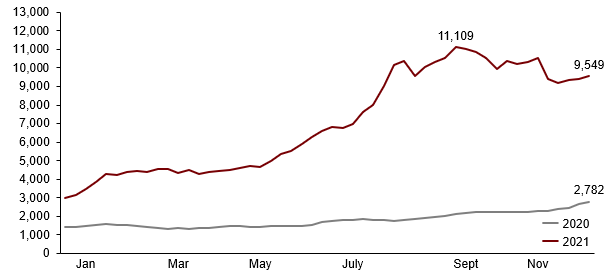

China’s zero-tolerance strategy to combat the pandemic has continued throughout the year, with reported cases remaining at very low levels as seen in Figure 1, with peaks leading to swift local responses to contain outbreaks. Authorities have continued to entirely lock down regions, cities, districts, and compounds with high granularity to prevent the spread of outbreaks. This has made domestic business travel challenging and contributed directly to operational problems. The closure of Meishan section of the Ningbo port, one of the biggest maritime hubs between China and North America, is a direct example of how the restrictions can impact supply chains1. Identification of confirmed cases from port workers forced the section of the port to close for weeks in August and again in December 2021, therefore, adding more pressure to the maritime supply chain.

Figure 1 – China’s daily new Covid-19 case count (from March 2020)

Source: Our World in Data, China: Coronavirus Pandemic Country Profile

The overall uncertainty, and in particular energy supply-related risks, global freight prices, and rise in China’s domestic wage levels led companies to consider alternative sourcing countries. However, despite the unfavorable factors, China has advantages both due to large domestic demand and a strong industrial eco-system that make it attractive for companies. During the year, many companies have experienced strong domestic demand and many foreign companies do invest heavily in local production to capture long-term strong demand in technologically advanced sectors.

Energy Restrictions & carbon impact

As China’s energy production is long-term shifting from a today’s highly coal-dependent energy system to more renewable energy, this year has shown the urgency of executing this shift and the great challenge of meeting an increasing demand for energy. The globally strong demand for physical goods and components was far higher than anticipated by planners and contributed to strain on the energy system where most electricity is consumed by industries.

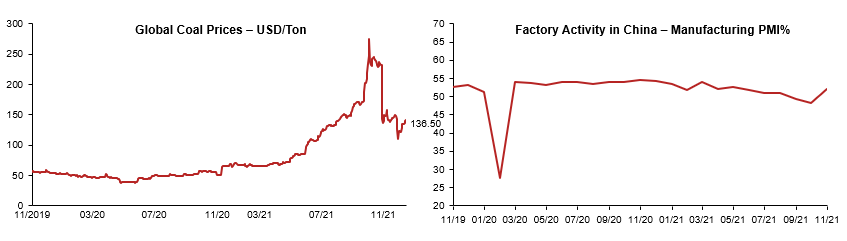

Figure 2 – Global Coal Price & Factory Activity Level

Source: Business Insider – Coal Prices, 2021 & Manufacturing Purchasing Managers’ Index, 2021

As global coal prices surged in mid-2021, the Chinese power producers were not prepared for such drastic increase. As a result, multiple provinces experienced electricity blackouts and sudden orders to stop industrial production – an emergency response from many local governments. Goldman Sachs in late September of 2021 predicted that up to 44% of China’s industrial activity would be affected by power restrictions in 20212.

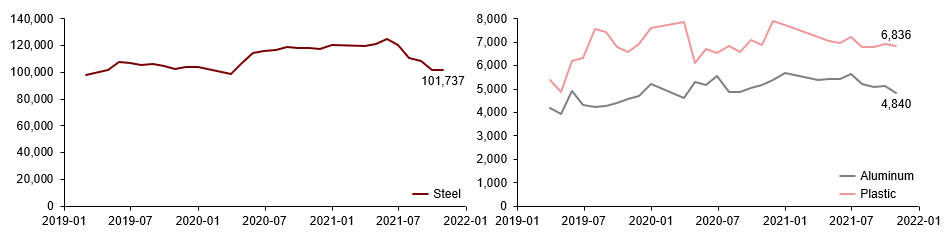

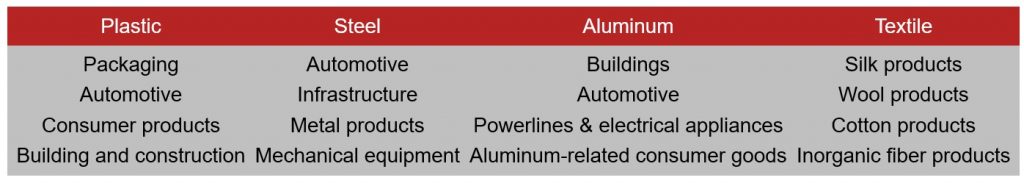

The energy restriction policies have heavily impacted industries with high energy usage, for example aluminum, plastic, and steel manufacturing industries, and contributed to declining output in second half of 2021. A key driver of transparency in 2022 is likely to be the upcoming EU carbon border tax 2026 and the new EU requirements on carbon dioxide data for imports already in 2023. As the Chinese emissions trading system is likely to be expanded, and prices currently much lower than the EU, energy intensive imports should expect rising costs in China.

Figure 3 – Monthly production output for aluminum, plastic, and steel, thousand tons

Source: Wind Financial information, December 2021

Energy availability and prices impact raw materials production and the downstream processing in many industries, highlighting the need for all to improve energy efficiency in the mid-term and manage uncertainty in the short-term production planning across industries.

Figure 4 – Examples of industries impacted by energy uncertainty and rising prices

Logistics Disruptions – significant maritime disruptions

The outbreak of Covid-19 has severely impacted the operations of the global container transportation system. Ports, railways, and road transportation networks have all experienced decreased efficiency and turnover rates – a direct consequence of the lack of human labor caused by various lockdowns and social restriction measures3. Besides, as consumers have shifted shopping preferences to ecommerce, online sales boomed in the west during the pandemic4. Online sales lead to high demand for delivery services, therefore, an increase in demand for containers

Figure 4 – Global freight rate for 40’ container, USD

Source: Freightos Baltic Index, December 2021

The recent supply chain disruptions have most heavily impacted China to North Europe & America routes: the China-North Europe route’s price as of December 2021 have reached a to-date peak of 14,345 USD per 40’ container, where the price used to be about 2,000 USD per 40’ container in 2020. This leads to significant disruptions, cost pressure and more companies shifting to rail or air, but also long-term concerns on viability of long supply chains in some product categories.

Logistics Disruption – Air transportation at reduced capacity

Air transportation has seen great reductions globally, with passenger flights to China particularly hard hit due to the restrictions on number of flights allowed. As of August 2021, the number of international flights coming in and out of the country are at 2.2% of the pre-Covid levels5 . Despite quarantine requirements, there is significant demand and passenger ticket prices remain at much higher levels than normal due to low supply of flights and increased operational costs due to Covid-prevention measures. As long as passenger flights are reduced, this will contribute to higher overall air-cargo prices in the absence of “belly-freight” with goods flying on commercial passenger planes.

The demand for air cargo has eased after the initial spike in demand at the start of the pandemic. However, the demand for air cargo is still in a strong growth phase in late 2021, and as long as sea freight problems remain it will be an increasingly relatively attractive option for some industries6.

Semiconductors – global demand surge and supply problems continuously impacting industry

As Covid-19 prompted consumers worldwide to shift to a more digital lifestyle, the demand for semiconductors skyrocketed in 2020. Aggressive growth in industries relying on semiconductors, such as healthcare equipment and smartphones & wearable devices, has drastically increased the demand for electronic components7. Furthermore, fear of continued shortages has caused companies to stockpile supplies and increased the demand towards already exhausted suppliers.

The semiconductor shortage has hit hard on the automotive industry in particular. Many automakers tend to run lean on supplies for their production to minimize costs of inventory and risk of having outdated components. A majority of the automakers cut semiconductor orders when the pandemic has started in early 2020. When the demand for vehicles soon bounced back during 2020, companies were caught off-guard as they after mitigating operational issues in their own production also did not have enough stock of semiconductors to meet the increase in orders for new vehicles8.

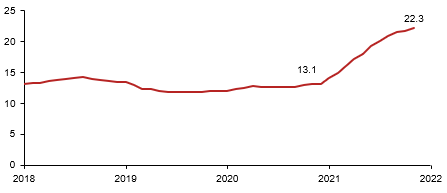

Figure 6 – Average global time gap between chip orders and delivery, (weeks)

Source: Susquehanna Financial Group, December 2021

The structural increase in long-term demand for semiconductors combined with the current supply-chain bottlenecks has severe implications on the semiconductor-reliant industries, and in particular for those with long product life cycles who rely on components that are too dated for manufacturers to invest in capacity. Companies should prepare for continued struggles to source semiconductors, for risks of prices rising further, and lead times to increase during 2022.

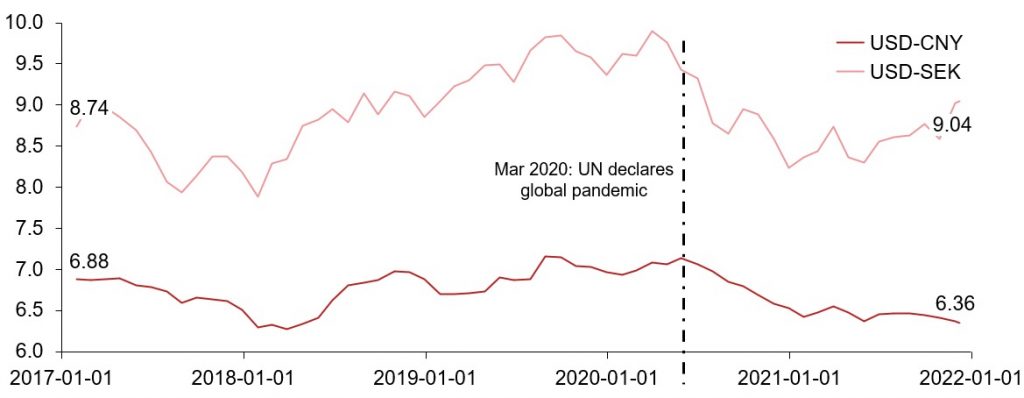

Currency – an appreciating CNY

Figure 5 – USD-CNY & USD-SEK Currency Exchange Rate

Source: WIN.D Terminal December 2021

Since the start of the pandemic, the uncertainty only had had minor impact on the CNY and SEK, that have appreciated against the USD, a different pattern from the common assumption on “flight to safety” to the dollar in times of increased uncertainty. The CNY has continuously experienced appreciation, with the USD-CNY currency exchange rate reaching a historical low of 6.36 in December 2021, reflecting a strong CNY. It is debatable whether this trend will continue, as further strengthening of the CNY impacts export competitiveness and pressure on productivity increases.

Regional Comprehensive Economic Partnership – RCEP as regional trade bloc

RCEP, the Regional Comprehensive Economic Partnership, consists of 15 countries who roughly equate 30% of the global GDP. The agreement, set to enter into force on the 1st January 2022, aims to expand business ties between the member countries, which include Australia, Brunei, Cambodia, China, Indonesia, Japan, the Republic of Korea, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, Thailand and Vietnam. The RCEP will eliminate 90% of tariffs within the bloc9, and should also boost China’s e-commerce platform selling goods to the Southeast Asia market. Furthermore, this may bring Japan, Korea, and China into closer cooperation and economic competition.

This is seen as a major step in closer regional cooperation, and more trade negotiations can be expected in the future10. For western companies, changes in the supply chain dynamics and fiercer competition across the trading bloc need to be put in relation to their footprint and industry dynamics to judge the strategic impact.

Companies need to be proactive

The recent year has shown the inherent uncertainties in doing global business with long, complex supply chains, with many factors which are out of the companies’ control severely impacting operations, but there are also many proactive actions companies can take:

Enhance communication with suppliers – minimize order fulfilment-related problems, as well ensuring getting updates on any arising issues related to production/delivery processes by having both clear and well-implemented routines with defined clear points of contact and establishing trust that enables ad-hoc problem solving for the unanticipated.

Increase transparency and implement better risk management processes – the pandemic has exposed many organizations’ risk management processes as being inadequate or not fully implemented, as some with comprehensive cross-functional management of risk have fared better than peers lacking this structured approach. Increasing transparency and traceability in the supply chain is a part of risk management that takes significant efforts but will bring benefits and increasingly be required by regulators and end-consumers.

Diversify supplier base – Companies should consider expanding their supplier base both within and beyond China, introducing backup suppliers and having a plan B as appropriate in their industry, so as to be able to act fast.

Review bargaining power in supply chain – By having an accurate understanding of the bargaining power and the company’s own pricing power that is reflected in contracts and processes, companies can secure better supply contracts, mitigate price changes effectively and reduce transaction costs.

Conduct scenario analysis – without actively re-evaluating the long-term viability of the current business in a changing context, companies can easily lose sight of both down-side risks and upside opportunities. By working with scenarios to push the thinking, companies can take better decisions now to position themselves for an uncertain future.

See the full report: China Supply Chain 2021 – Swedcham AP