COVID-19 FLASH SURVEY: SWEDISH COMPANIES STRUGGLE AS CHINA BATTLES RECENT OMICRON OUTBREAKS

Posted on

Beijing April 28, 2022

The pandemic has over the past few years posed challenges to international trade and the global economy. While some markets are on the road to recovery, the recent outbreaks in China have triggered strict containment efforts with an impact on both individuals and companies. The developments in Shanghai since late March affect many Swedish businesses, as many of them have offices, production, and logistics infrastructure in the area.

The survey shows that the containment efforts have strongly disrupted Swedish companies’ operations in the country, negatively affecting their short-, mid-, and long-term outlooks.

The survey should be seen as a supplement to the more holistic annual Business Climate Survey for Swedish companies in China, to isolate the impact on business from the recent pandemic control measures. However, it is worth noting that there are several other factors that also have an impact on business decisions and results.

Between April 19 and 22, 2022, Business Sweden and the Swedish Chamber of Commerce in China (SwedCham) conducted a joint flash survey on the impact of the recent COVID-19 outbreaks on Swedish businesses in China. 120 member companies of SwedCham participated in the survey.

COMPANIES ARE AFFECTED RIGHT NOW

The current COVID-19 outbreaks in several major cities across China have strongly disrupted Swedish companies’ operations in the country. Lockdowns and tightened quarantine measures have had an impact on the operation and business performance of most companies in the short-term.

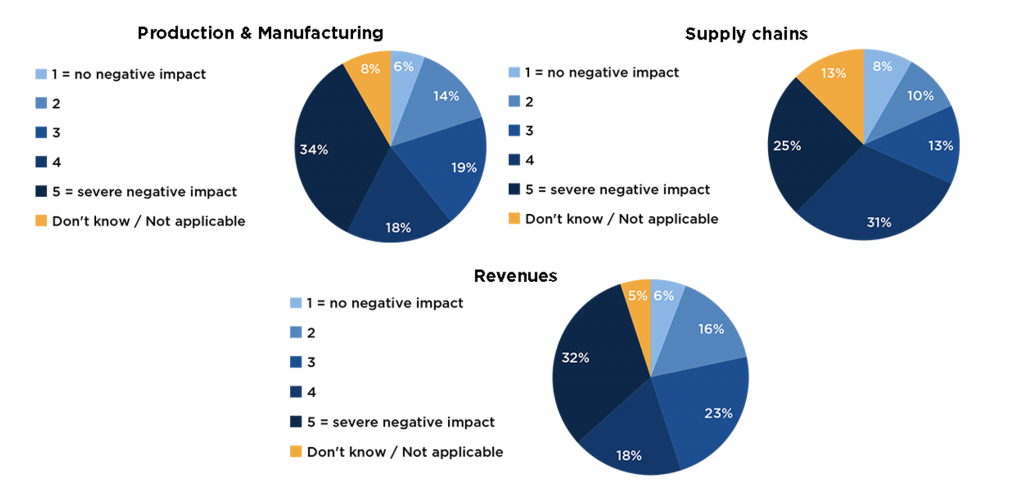

- Production and manufacturing: 86 per cent of all companies reported a negative impact (options 2-5 on a 1-5 scale) on their production and manufacturing, with 34 per cent describing the impact as severe (5).

- Supply chains: 79 per cent of all companies reported a negative impact on their supply chains, with 25 per cent describing the impact as severe. Hardest hit were consumer companies as well as large industrial companies, for whom the negative impact on supply chains were 100 per cent and 94 per cent, respectively.

- Revenues: 89 per cent of all companies reported a negative impact on their revenues, with 32 per cent describing the impact as severe. Only 2 per cent of industrial companies did not report any negative impact on their revenues due to the recent COVID-19 outbreaks.

THE MARKET IS GETTING LESS ATTRACTIVE

For the medium-term outlook, the uncertainties from the outbreaks and containment measures have prompted Swedish companies to reexamine their investments in China and expectations on the market.

- Investment plans: 68 per cent of all companies reported a negative impact on their investment plans, with 14 per cent describing the impact as severe. In addition, 68 per cent of respondents said the recent outbreaks had affected their view of the Chinese market negatively, with almost one in five companies (19 per cent) describing the market as significantly less attractive.

- Foreign staffing: 66 per cent of all companies reported a negative impact on their foreign staffing, with 25 per cent describing the impact as severe. The extra toll that the combination of international travel restrictions and strict local lockdowns take on foreign staff are mentioned by several companies, who cite concerns about how issues of retaining foreign staff will affect company operations down the line.

BUSINESSES BRACE FOR FURTHER DISRUPTIONS

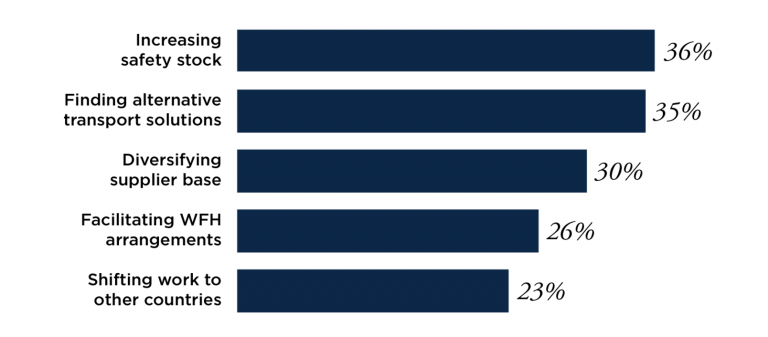

Looking ahead, 82 per cent of companies said they are considering some preventive measures to be able to better deal with future outbreaks, including increasing their safety stocks (36 per cent), finding alternative transport solutions (35 per cent), and diversifying their supplier base (30 per cent). Facilitating for employees to work from home, a popular measure taken by Swedish companies in Sweden, is being planned by a fourth of companies (26 per cent).

For large industrial companies, apart from other preventative measures, 41 per cent of respondents said they are assessing the possibility of shifting work away from China. An additional 19 per cent said they are looking at moving regional functions out of the country. For all companies, the corresponding numbers are 23 per cent and 13 per cent, respectively.

TIME TO PREPARE FOR FUTURE IMPACT

Until the recent outbreaks, and subsequent lockdowns, the market in China has to some extent been supportive of Beijing’s zero-COVID policy. But as the rest of the world is learning to live with the pandemic, foreign businesses in China are becoming increasingly frustrated with the government’s approach and its impact on their bottom lines. With uncertainty about the easing of current policies, Swedish companies in China need to start planning for how they can best minimise the negative impact of future containment measures and lockdowns to continue thriving in the Chinese market.

The pandemic has taught us that it is very difficult to predict the future, and right now there is a high level of uncertainty with regards to both deployment of containment measures as well as the long-term economic impact. But companies need to be prepared for external events triggering a rapid impact on both the supply and demand side. This has not only been evidenced by the pandemic response measures, but also by activities such as the power outages in China during the fall of 2021. Even if the exact solutions depend on the business nature and value chain configuration, it is wise to look into: a) scenario planning in order to be prepared, and b) diversification in order to minimise impact. It is seldom a wise strategy to put all eggs in one basket, and not have any plans for how to shift the eggs when the basket breaks. If your company has not already examined how to mitigate and respond to similar situations, it might be a good time to do so now. The only thing certain, is that the future remains uncertain.